Introduction

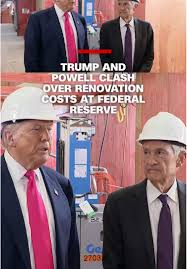

The interactions between former U.S. President Donald Trump and Federal Reserve Chairman Jerome Powell have garnered significant attention in recent years. Trump’s unconventional approach to governance, especially concerning economic policies, directly influenced Powell’s decisions at the Federal Reserve. This relationship is crucial for understanding the dynamics of U.S. fiscal and monetary policy, especially in a post-pandemic economy.

Trump’s Pressure on Powell

During his presidency from 2017 to 2021, Donald Trump frequently criticized Jerome Powell and the Federal Reserve’s monetary policy. In 2018, Trump publicly expressed discontent with rate hikes, suggesting they could hinder the economic growth he claimed to have stimulated through tax cuts and deregulation. Trump described Powell as being “crazy” for rate increases, hinting at a desire for a more accommodating monetary policy to foster higher stock market gains.

Powell’s Independence and Challenges

Despite Trump’s pressures, Jerome Powell maintained that the Federal Reserve would operate independently, focusing on the central bank’s dual mandate: maximizing employment and stabilizing prices. In a historic move, amid the pandemic’s onset in March 2020, Powell slashed interest rates to near-zero and implemented unprecedented quantitative easing programs. These decisions were pivotal in stabilizing the markets and supporting the economy during a tumultuous period.

The Road Ahead

As the Biden administration took office, Powell’s position remained scrutinized amid rising inflation and ongoing recovery from economic downturns. Trump’s influence on Powell’s policies and the Fed’s operational strategies remains a topic of debate, particularly as Powell’s decisions will significantly impact the economic environment leading into the 2024 elections.

Conclusion

The interplay between Donald Trump and Jerome Powell illustrates the delicate balance between political influence and economic policy making. As inflation concerns rise and the Fed strategizes on interest rates and economic stimulus measures, observers will be watching closely. With speculation about Trump’s possible return in 2024, the implications of their relationship could reshape U.S. monetary policy in ways that resonate for years to come.