Importance of Tracking Whitecap Resources Stock

As one of Canada’s significant players in the energy sector, Whitecap Resources Inc. (TSX: WCP) is publicly traded on the Toronto Stock Exchange. Understanding the performance of Whitecap Resources stock is crucial for investors, energy analysts, and economic enthusiasts, given the fluctuating landscape of the oil and gas market. This article delves into recent developments surrounding Whitecap’s stock and its implications for investors.

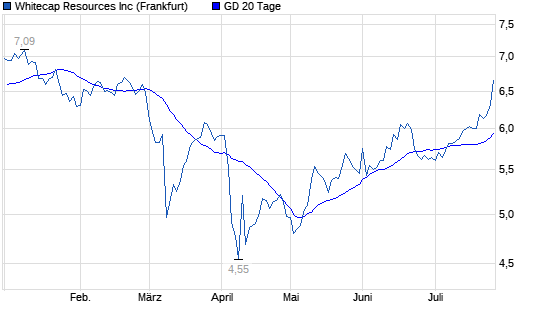

Recent Stock Performance

Over the past few months, Whitecap Resources has demonstrated resilience in its stock performance, reflecting broader trends in the oil and gas industry. As of the end of October 2023, the stock price has experienced a moderate increase, currently trading around CAD 12 per share, up from CAD 10.50 just a few months prior. This upward trend can be attributed to several factors, including rising crude oil prices and the company’s positive quarterly reports.

Factors Influencing Whitecap Resources Stock

Multiple factors play a role in shaping the stock’s trajectory. Firstly, global oil prices have seen an uptick due to geopolitical tensions and production cutbacks from OPEC nations. In October 2023, the price of WTI crude oil surpassed CAD 80 a barrel, directly benefitting companies like Whitecap Resources, which relies on oil production revenues.

Additionally, Whitecap’s solid financial results are noteworthy. In their recent quarterly report, Whitecap announced a net income increase of 15% compared to the previous quarter, driven by increased production levels and effective cost management. This strong performance has built investor confidence, further propelling the stock’s price higher.

Moreover, analysts foresee continued growth in Whitecap’s production output as the company expands its operations in strategic regions. The firm has allocated significant capital expenditures aimed at drilling new wells and enhancing extraction techniques, which could lead to improved future earnings.

Conclusion and Expected Trends

The outlook for Whitecap Resources stock appears positive, buoyed by both macroeconomic factors and the company’s internal strategies. While market volatility can always pose risks, stronger crude prices and effective management strategies are likely to sustain interest in Whitecap Resources among investors. As always, potential investors should conduct thorough research and possibly consult with financial advisors to assess individual risk tolerance and investment goals before making any decisions.

As the energy market continues to evolve, keeping abreast of changes in Whitecap Resources stock will be critical for those engaged in the sector or considering investment opportunities.