Introduction

The earnings report of Alphabet Inc. for the third quarter of 2023 has garnered significant attention from investors and analysts alike. As the parent company of Google, Alphabet’s financial performance is crucial in understanding the broader tech market trends. With the tech industry facing challenges such as inflation and changing consumer behaviors, examining Alphabet’s earnings provides insight into how one of the world’s largest tech companies is navigating these headwinds.

Quarterly Performance Overview

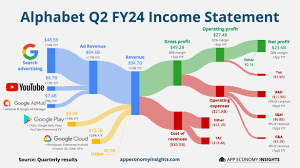

Alphabet reported a revenue of $76.8 billion for Q3 2023, marking a 10% increase year-over-year. This growth was primarily driven by a recovery in digital advertising spending and the expanding user base of its cloud services. Google Cloud’s contribution reached $8 billion, reflecting a 30% increase from the previous year. The strong performance was accompanied by earnings per share (EPS) of $1.67, exceeding analysts’ expectations of $1.50.

Advertising Revenue

One of the most critical segments for Alphabet remains its advertising revenue, which totaled $61.7 billion, a significant increase from $55 billion in the same quarter last year. The resurgence in advertising can be attributed to businesses reallocating budgets towards digital platforms in response to a recovering economy as inflation pressures ease. Many advertisers focused on performance-driven campaigns, which further solidified Google’s dominance in the space.

Cloud Services and Other Ventures

Alphabet’s cloud services sector continues to show promising growth. The $8 billion generated this quarter underlines the increasing reliance on cloud technology across various industries. Additionally, YouTube, which is now seen as a vital component of Alphabet’s overall strategy, provided $7.8 billion in ad revenue, showing a steady health in the direct-to-consumer advertising landscape.

Challenges and Forecast

However, the path forward is not without challenges. Concerns over privacy regulations and antitrust scrutiny loom large, potentially impacting operations. In response to these challenges, Alphabet is investing heavily in artificial intelligence and machine learning to bolster its competitive edge.

Conclusion

The Q3 2023 earnings results from Alphabet have reinforced investor confidence in the company’s resilience and its ability to adapt to the changing market dynamics. Looking ahead, experts anticipate that Alphabet will continue to diversify its revenue streams, focusing more on AI initiatives and enhancing its cloud services. The insights gained from this quarter’s performance will be vital for stakeholders as they assess the company’s future directions and growth potential amidst the evolving tech landscape.