Introduction

Oklo Inc., a key player in the nuclear energy sector, is attracting significant attention as investors look towards sustainable energy solutions. Given the growing emphasis on reducing carbon footprints and the transition to clean energy, understanding the performance of Oklo stock is crucial for potential investors. With nuclear power being recognized as a viable alternative to fossil fuels, Oklo’s advancements in compact nuclear reactor technology are not only innovative but potentially lucrative.

Recent Performance

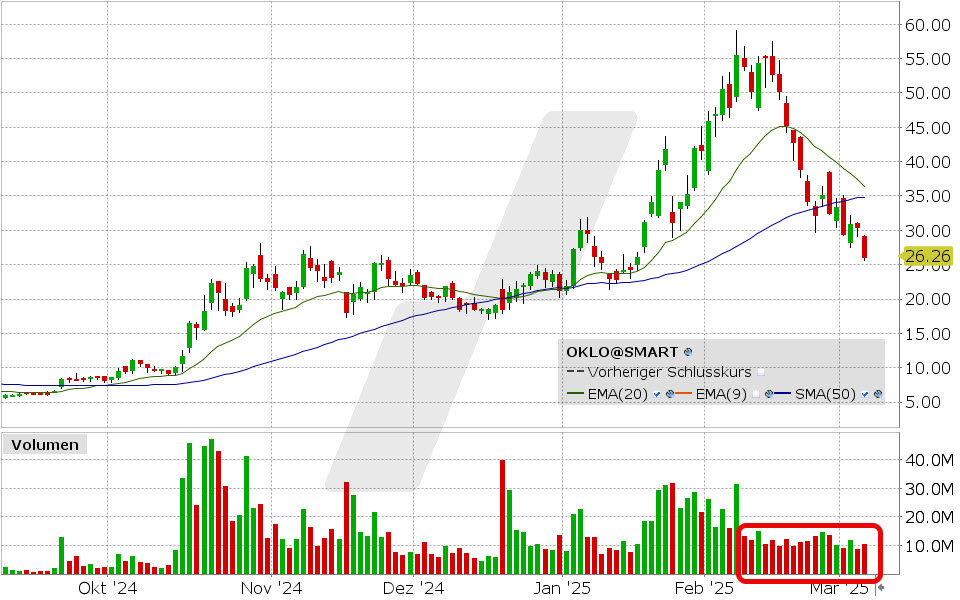

As of October 2023, Oklo stock has demonstrated substantial volatility, reflecting broader market trends affecting the renewable energy sector. In the past three months, the stock has seen a price increase of approximately 15%, spurred by recent developments in technology and a series of positive earnings reports. Investors have reacted favorably to Oklo’s recent collaborations with several government agencies focused on renewable energy initiatives.

Technological Advancements

Oklo’s new compact nuclear reactors are designed to be more efficient and cost-effective than traditional reactors, making them attractive to energy providers. The company’s unique approach—combining advanced engineering with a streamlined design—attracts attention from both public and private sectors. In a recent press release, Oklo announced a partnership with the U.S. Department of Energy, aimed at funding the deployment of its reactors in regions looking to phase out coal and other polluting energy sources.

Market Trends and Analyst Insights

Analysts have indicated that Oklo could be well-positioned to benefit from upcoming legislative changes that promote clean energy sources. The increasing demand for sustainable energy and government incentives for nuclear power could translate into growth opportunities for the company. Several investment firms have upgraded their ratings on Oklo stocks, considering it a strong buy for long-term growth. However, analysts also warn that ongoing concerns about public perception of nuclear energy and potential regulatory challenges could impact future performance.

Conclusion

As both investors and industry experts keep a close eye on the renewable energy market, Oklo stock emerges as a noteworthy option. The current interest in nuclear energy as part of the solution to climate change, coupled with the company’s innovative technology developments, suggests that excited investors should monitor Oklo closely. While risks remain, particularly in public sentiment and regulatory environments, future developments could see Oklo solidly positioned in the evolving energy landscape. Overall, the outlook on Oklo stock appears promising, making it a topic worth following for those interested in sustainable investment opportunities.