Introduction

QS Stock, representing Quanshi Technology, has recently garnered significant attention due to the company’s innovative approaches in technology and the evolving market landscape. As investors are constantly seeking profitable opportunities, understanding QS Stock’s performance is vital for making informed decisions. With the increasing demand for tech solutions, the relevance of QS Stock has escalated, making it a focal point for market watchers and investors alike.

Recent Performance

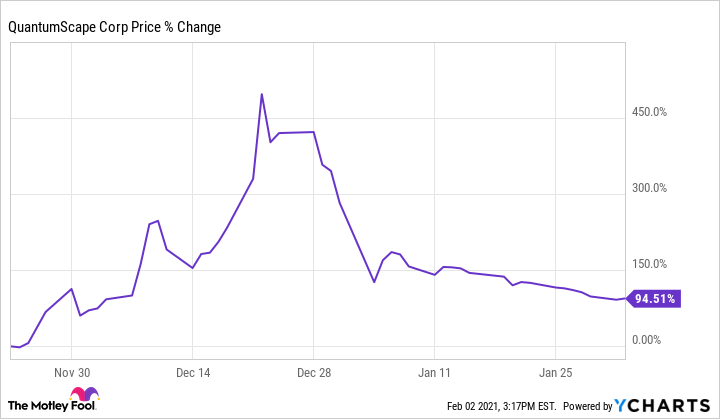

In the past few months, QS Stock has seen notable volatility, reflective of broader market trends and investor sentiment. As of late October 2023, QS Stock has experienced a rise of approximately 15%, which analysts attribute to the company’s successful launch of its new product line geared towards artificial intelligence applications. This surge is particularly significant when compared to the overall tech stock market, which has fluctuated with varying levels of optimism.

Quanshi Technology announced earlier this month that their new AI-driven analytics platform would begin shipping next quarter, further solidifying investors’ confidence. Analysts have revised their forecasts, projecting a further 20% growth in the next fiscal year as demand for AI applications continues to escalate across numerous sectors, including healthcare, finance, and cybersecurity.

Market Trends and Investor Sentiment

The positive trajectory of QS Stock appears to align closely with a growing interest in tech stocks, particularly those involved in innovative sectors such as artificial intelligence. According to recent reports, 70% of investors in the tech domain see potential in further investments in AI technologies, hinting at a broader acceptance and anticipation for future gains. Additionally, a recent survey revealed that 60% of industry experts forecast continued expansion in the AI market, emphasizing the relevance of tech stocks like QS.

Understanding the underlying factors driving QS Stock is crucial for current investors. Analysts suggest keeping an eye on the company’s quarterly reports and product launches as key indicators for future performance. Furthermore, investors are advised to assess their portfolios carefully, considering the tech sector’s inherent volatility.

Conclusion

In summary, QS Stock has emerged as an enticing investment opportunity amid a dynamic market landscape. With promising developments and a keen focus on artificial intelligence, Quanshi Technology is well-positioned for future growth. However, potential investors should conduct thorough research and remain cautious of the inherent risks that accompany tech stocks. Moving forward, monitoring the company’s strategic moves will be essential for anyone looking to capitalize on the opportunities presented by QS Stock.