Introduction

As technology investors actively seek opportunities in the volatile landscape of cryptocurrency and data analytics, MSTR stock (MicroStrategy Incorporated) has become a focal point for both bullish and bearish sentiments. MicroStrategy’s strategic investment in Bitcoin has positioned it uniquely within the tech sector, raising questions regarding its financial sustainability and long-term growth potential.

Recent Developments

In 2023, MicroStrategy has continued to bolster its Bitcoin holdings, amassing over 150,000 bitcoins, which significantly influences its stock valuation. The company’s aggressive purchasing strategy, backed by the vision of CEO Michael Saylor, aims to leverage Bitcoin as a primary treasury reserve asset. As of late September 2023, MSTR stock was trading at approximately $300 per share, a considerable rise from its previous year due to the upward momentum of Bitcoin prices.

Moreover, MicroStrategy has been expanding its software capabilities by launching new enterprise analytics products that incorporate artificial intelligence, which could diversify its revenue streams beyond cryptocurrency investments. These developments have prompted analysts to reassess MSTR, especially in the context of changing investor sentiments toward crypto assets.

Market Performance and Investor Sentiment

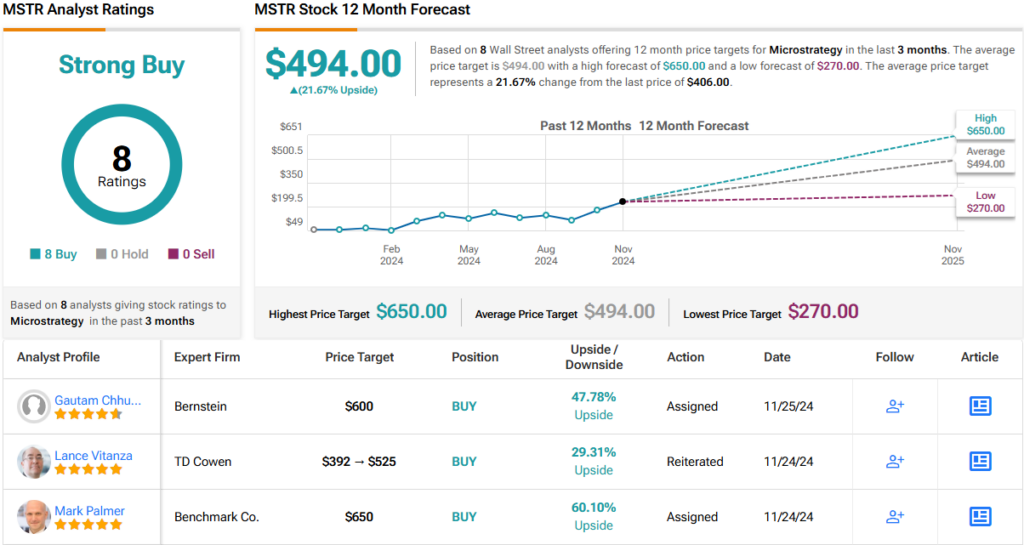

Despite the recent stock performance improvements, MSTR stock remains highly volatile, mirroring the unpredictable nature of cryptocurrency markets. Analysts are divided on the future trajectory of MicroStrategy’s share prices. Some view it as a high-risk, high-reward opportunity, while others caution that its heavy reliance on Bitcoin may expose the company to significant financial risks in case of a downturn in the market.

Data from financial analysts revealed that MSTR’s price-to-earnings ratio is higher than industry averages, suggesting that its stock may be overvalued, especially as market sentiments fluctuate. In a recent survey, 65% of institutional investors expressed apprehension about holding such a volatile asset, preferring to observe until clearer market trends emerge.

Conclusion

Overall, the outlook for MSTR stock continues to be a topic of heated debate among market watchers. As MicroStrategy integrates its software development with ongoing Bitcoin investments, the coming months will be crucial in determining whether it can successfully balance growth with the inherent risks associated with cryptocurrencies. For individual investors, it’s essential to keep abreast of changes in market dynamics and MicroStrategy’s strategic decisions to assess the viability of adding MSTR stock to their portfolio. As the market evolves, so too will the narratives surrounding MicroStrategy, making it a stock to watch closely in the technology and cryptocurrency intersections.