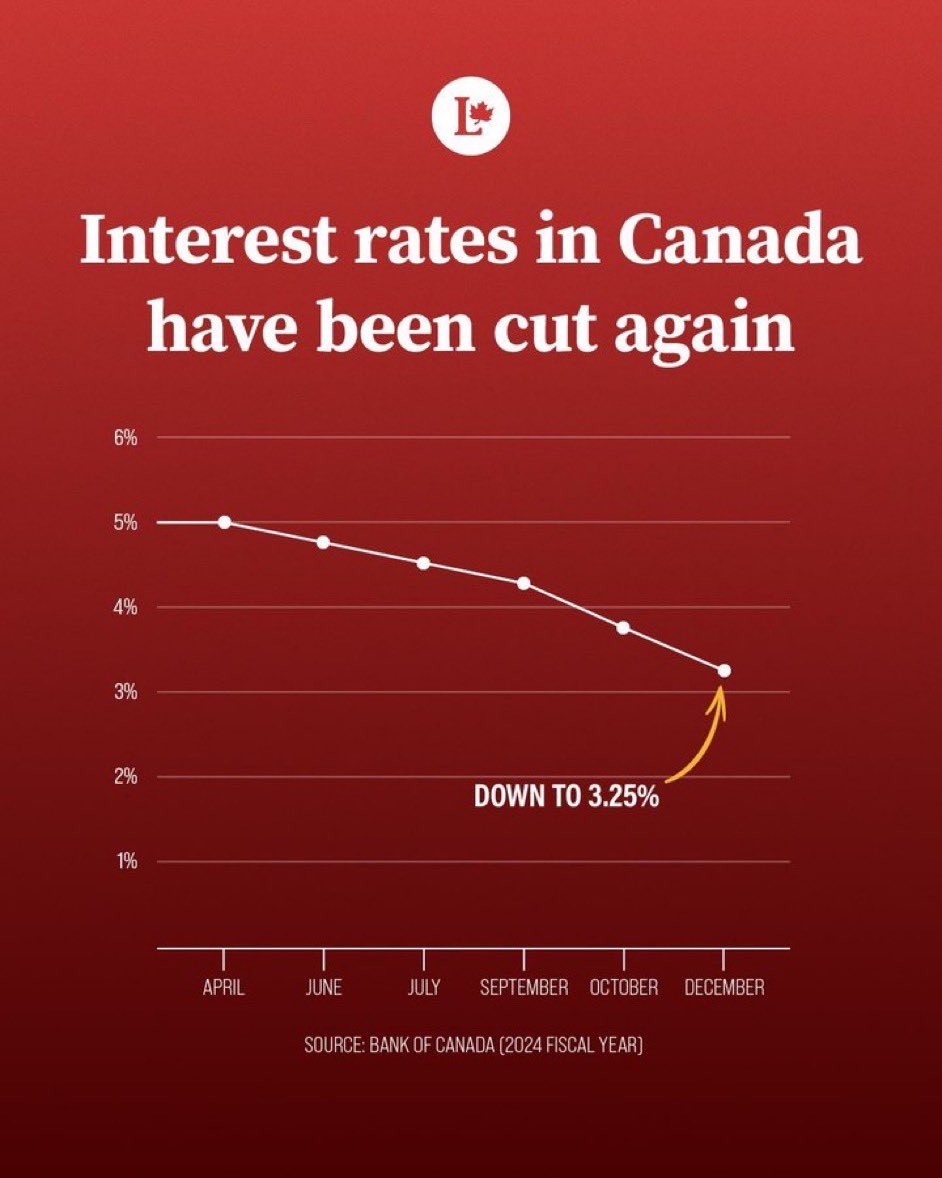

The Importance of Interest Rates in Canada

Interest rates are a crucial aspect of any economy, influencing borrowing costs, consumer spending, and investment strategies.

In Canada, the Bank of Canada (BoC) plays a pivotal role in setting the benchmark interest rates, which have significant implications for businesses and consumers alike. Recent fluctuations in interest rates have sparked discussions about their broader effects on the Canadian economy, especially against the backdrop of rising inflation and global economic uncertainty.

Current Interest Rate Trends

As of October 2023, the Bank of Canada has maintained its trendsetting interest rate at 5.00%, marking a significant increase from the pandemic-era lows. This decision reflects ongoing efforts to combat escalating inflation, which has risen above 3% in various sectors. The BoC’s stance is shaping the financial landscape in Canada, with mortgage rates and loan costs rising accordingly.

The most recent meeting of the BoC indicated the central bank’s commitment to curbing inflationary pressures while supporting economic growth. In a statement released in early October, Governor Tiff Macklem highlighted the importance of addressing price stability as a pathway to sustainable economic prosperity.

Impact on Consumers and Businesses

Higher interest rates mean that consumers face increased costs when borrowing money, which can lead to cooling demand for goods and services. For potential homebuyers, heightened mortgage rates create additional barriers to homeownership, impacting the real estate market across Canadian cities.

For businesses, elevated interest rates may result in increased operational costs, leading to slower investment in growth initiatives. The Canadian Federation of Independent Business (CFIB) has expressed concerns, noting that small businesses are particularly vulnerable to rising rates, which could hamper their recovery efforts post-pandemic.

Future Projections and Economic Outlook

Analysts are divided on the future trajectory of interest rates. Some experts suggest that rates may remain steady through 2024 as the BoC assesses the inflation situation, while others anticipate potential cuts should inflation cool in response to the current rate environment.

In conclusion, understanding the implications of Canada’s interest rates is essential for consumers and businesses alike. As the landscape evolves, the actions of the Bank of Canada will remain central to the economic narrative, influencing various sectors across the nation. Staying informed will allow individuals and organizations to navigate these changes strategically and effectively.