Introduction

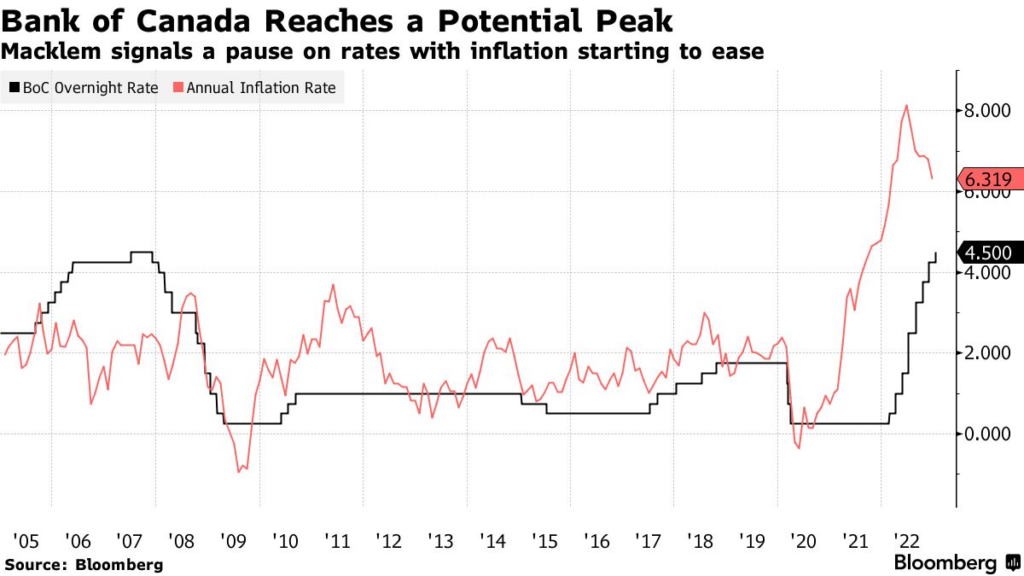

Interest rates are a critical factor in economic stability and growth, impacting everything from individual loans to corporate investments. In Canada, interest rates set by the Bank of Canada play a vital role in influencing consumer behavior, home buying, and overall economic performance. As of late 2023, the discussion surrounding interest rates has gained renewed urgency amid inflationary pressures and shifting economic conditions.

Current Interest Rate Landscape

As of November 2023, the Bank of Canada maintains the overnight rate at 5.00%, a level that has been held steady since the last increase in September 2023. This decision comes in response to ongoing concerns about inflation, which has remained above the target range of 1-3%. The Consumer Price Index (CPI) rose by 4.2% year-over-year in October, although it has shown signs of stabilization.

The Bank’s monetary policy aims to temper inflation while considering the economic growth rate, which is showing signs of slowing. In the third quarter, Canada’s GDP growth was only 1.2%, illustrating a deceleration that may compel the Bank of Canada to reassess its approach as the year wraps up.

Impact on Consumers and Businesses

With interest rates at elevated levels, Canadians are feeling the impact. Mortgage rates have surged, leading to higher monthly payments for homeowners and potential cooling off in the housing market. As credit becomes more expensive, consumers may be more hesitant to borrow, which could have a ripple effect on retail spending and investment by businesses.

For businesses, particularly in sectors sensitive to borrowing costs such as construction and manufacturing, the high interest rates may deter expansion plans or new projects. Small businesses, often reliant on loans for growth, could face challenges that hinder their development in a tightening economic environment.

Looking Ahead

Looking forward, forecasts suggest that interest rates may stabilize or even decrease if inflation shows continuing signs of containment. Economists are divided on when the Bank of Canada may act, but many agree that a cautious approach will be taken to avoid shocking the economy further.

Conclusion

The current interest rate policy in Canada reflects a balancing act between curbing inflation and supporting economic growth. For consumers and businesses alike, the impact of these rates is felt across a range of financial decisions. As 2023 draws to a close, the focus will remain on the data and economic indicators that may influence future monetary policy, making it essential for Canadians to stay informed about these developments.