Introduction

The US stock market is a crucial component of the global financial landscape, significantly impacting investments, trade, and economics. With many investors actively trading stocks, understanding the hours during which the US stock market operates is essential for making informed decisions. This knowledge not only helps in optimizing trading strategies but also in seizing opportunities and minimizing risks in a fast-paced market environment.

Market Hours

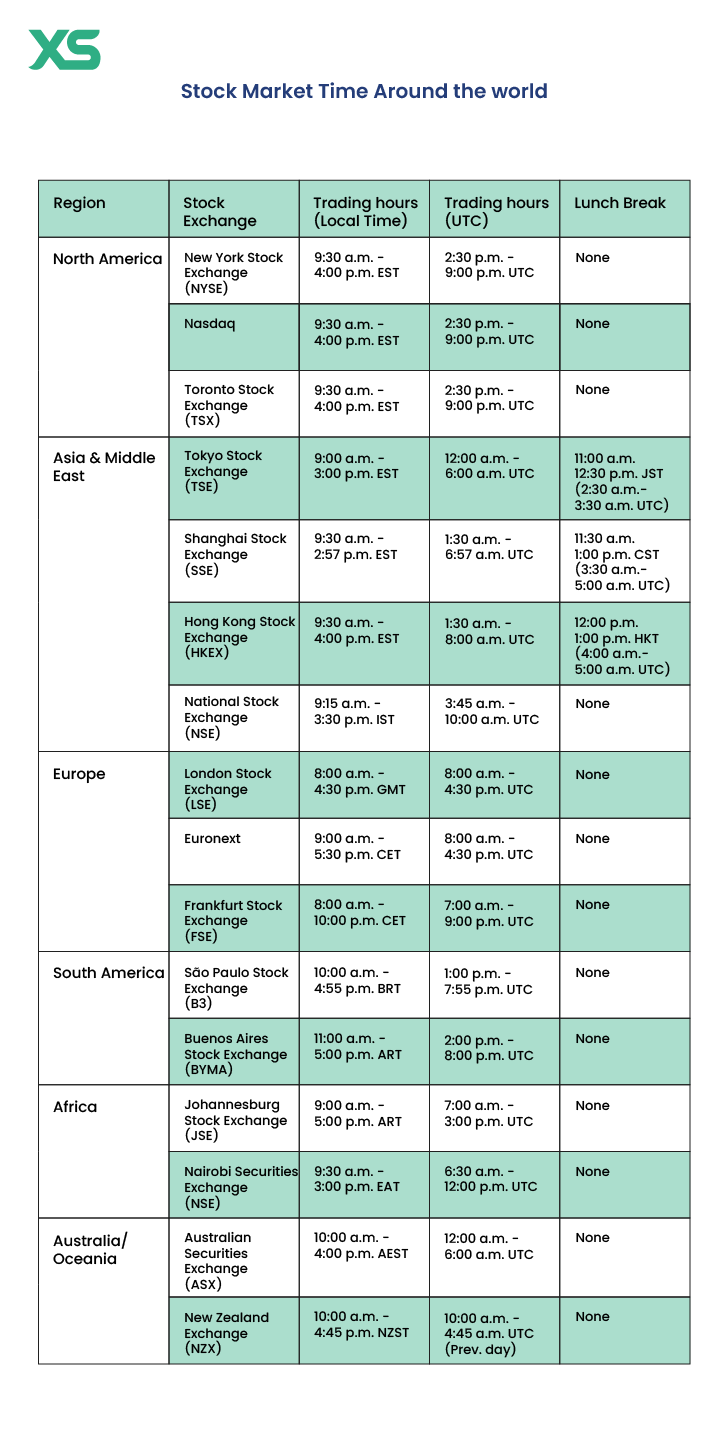

The NYSE (New York Stock Exchange) and NASDAQ are the two primary exchanges in the US, with specific operating hours. Both exchanges typically operate from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding public holidays. Pre-market trading occurs from 4:00 AM to 9:30 AM ET, while after-hours trading runs from 4:00 PM to 8:00 PM ET. These extended hours allow traders to react to news and events outside of regular trading hours, although they come with increased risk due to lower liquidity.

Importance of Market Hours

Understanding these hours is vital for different types of investors. For day traders, who buy and sell stocks within the same day, regular hours present the most significant opportunity for profits. However, extended hours can provide unique advantages, such as reacting to earnings reports, economic indicators, or geopolitical events that may affect stock prices. Investors are encouraged to familiarize themselves with the dynamics and volumes during these times since they may vary significantly from regular trading hours.

Conclusion

In conclusion, knowing the US stock market hours is imperative for both novice and seasoned traders. As the financial markets evolve, staying informed about trading hours can lead to strategic advantages and better investment outcomes. As we move into 2024, market participation may increase due to changing economic factors and technology advancements, and being aware of when to trade could prove beneficial for investors across the globe. Understanding these hours can also foster better decision-making, enabling investors to optimize their portfolios and navigate the complexities of the stock market more effectively.