Introduction

The S&P 500, or Standard & Poor’s 500, is one of the most important stock market indices in the United States and a key indicator of the overall health of the U.S. economy. Comprising 500 of the largest publicly traded companies, it reflects the performance of sectors ranging from technology to healthcare. As investors seek to understand market trends and make informed decisions, the S&P 500 serves as a crucial benchmark for stock performance.

Recent Performance

As of early October 2023, the S&P 500 has shown a remarkable recovery since the market downturn experienced in 2022. The index has increased approximately 15% year-to-date, with significant contributions from technology giants such as Apple, Microsoft, and Nvidia. This upward trajectory is largely attributed to strong corporate earnings, easing inflation rates, and shifts in investor sentiment towards riskier assets.

Additionally, the Federal Reserve’s recent decisions regarding interest rates have also influenced market dynamics. Lower-than-expected inflation has allowed the Fed to adopt a more dovish stance, further buoying investor confidence. Analysts predict that if this trend continues, the S&P 500 may reach all-time highs, reflecting broader economic recovery.

Significance for Investors

The S&P 500 is not only a tool for measuring market performance but also serves as a go-to index for investors looking to invest in diversified portfolios. Funds that track the S&P 500 are among the most popular investment vehicles globally, allowing investors to gain exposure to a wide array of sectors without the need to pick individual stocks. This diversification minimizes risk while aiming for consistent returns.

Future Outlook

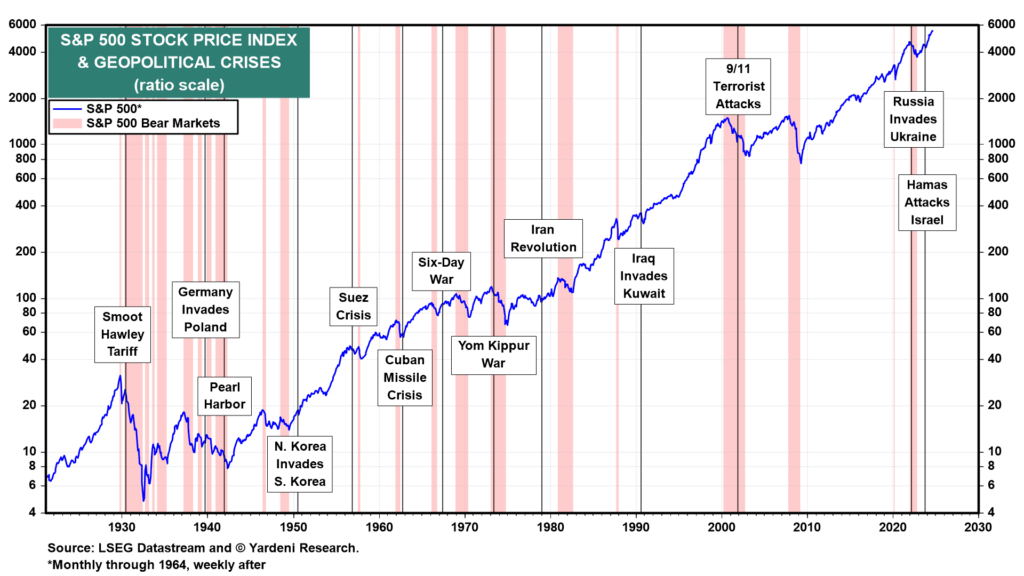

Looking ahead, market analysts suggest that the S&P 500 will continue to be influenced by various factors, including global economic conditions, geopolitical tensions, and advancements in technology. As the market braces for potential shifts, investors are advised to maintain a keen eye on economic indicators, quarterly earnings reports, and developments in fiscal and monetary policies.

Conclusion

The S&P 500 remains an essential index for both seasoned and novice investors, embodying the performance of the U.S. economy and stock market. Understanding its trends and performance is crucial for making informed investment decisions. As we move into the latter part of 2023, the index will likely serve as a barometer for economic stability and growth prospects, thus continuing to play a significant role in the investment landscape.