Introduction

The concept of a Digital Services Tax (DST) has gained significant traction globally, with countries like Canada exploring its implementation to ensure fair taxation of multinational digital companies. As e-commerce and online services continue to expand, the relevance of DST emerges as a critical issue for policymakers aiming to level the playing field between local businesses and global tech giants.

The Rise of the Digital Services Tax

In recent years, the rapid growth of digital platforms such as Google, Amazon, and Facebook has led to increasing scrutiny regarding their tax contributions in countries where they operate. In Canada, the proposed Digital Services Tax aims to impose a tax on revenues generated by these large corporations from digital services provided to Canadian users.

Details of the Proposed Tax

The Canadian government announced the DST plan in its 2021 budget, outlining a tax rate of 3% on certain revenues earned by foreign digital companies with substantial operations in Canada. This includes revenue from online advertising, streaming services, and marketplace sales. The tax is expected to take effect on January 1, 2024, pending final regulations and consultations.

Global Context

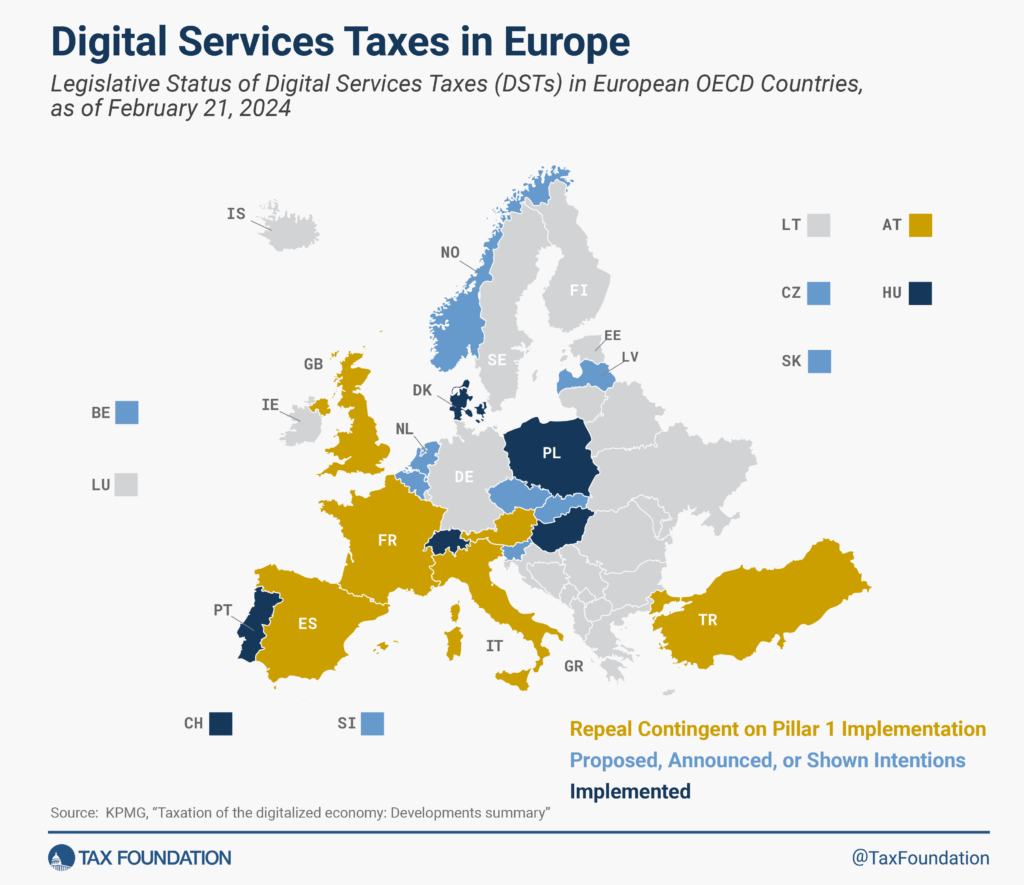

Canada’s move aligns with efforts from other nations, including France and the United Kingdom, which have already implemented similar taxes. The Organisation for Economic Co-operation and Development (OECD) is also in ongoing discussions to establish a framework for global taxation of digital services. As countries scramble to adapt to the challenges of a digital economy, the disparities in tax contributions by tech giants have come under the spotlight.

Potential Implications

The Digital Services Tax may face opposition from affected companies and other stakeholders who argue that it could lead to increased costs for consumers and impact investment in the Canadian market. Furthermore, there are concerns about potential trade disputes with the United States, which has criticized such taxes as discriminatory. Nevertheless, proponents argue that it creates a necessary revenue stream to support public services and helps protect local businesses.

Conclusion

As Canada moves closer to implementing the Digital Services Tax, it will be crucial for stakeholders to engage in discussions around its effectiveness and economic impact. The tax represents a significant shift in how digital companies contribute to the economies in which they operate. Moving forward, the success of the DST will depend on its design, implementation, and the extent to which it addresses inequities within the digital marketplace. With the increasing reliance on digital services, Canadians will need to stay informed about how this tax might affect their online experiences and local business landscapes.