Introduction

MU stock, the ticker symbol for Micron Technology, Inc., remains a focal point in the technology and semiconductor sectors. As the demand for memory and storage solutions continues to surge globally, Micron has become a key player worth monitoring. With recent fluctuations in the stock market and evolving industry trends, understanding the current performance and future outlook of MU stock is crucial for investors.

Recent Performance of MU Stock

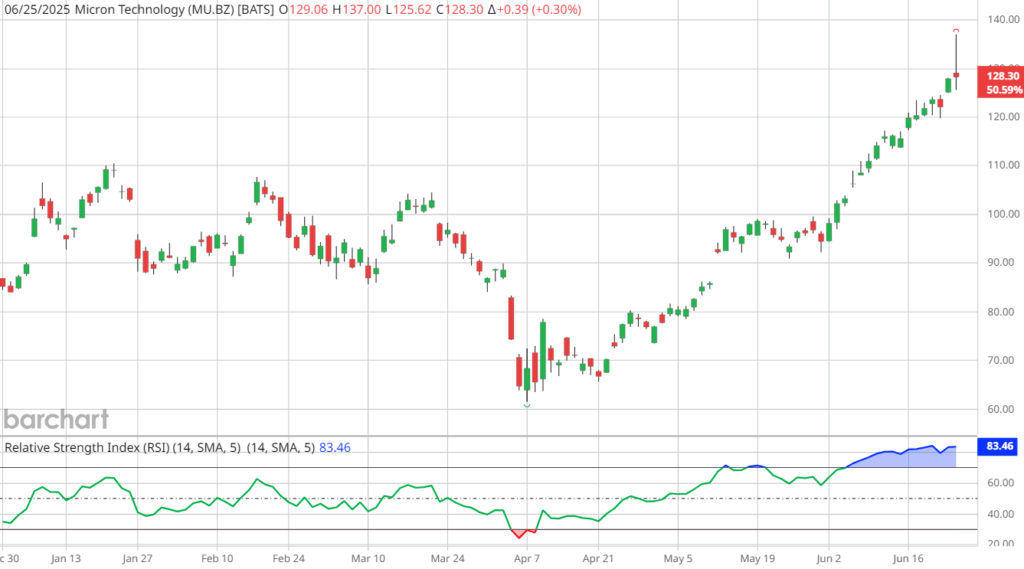

As of October 2023, MU stock has experienced notable volatility amidst changing market conditions. The stock opened at approximately CAD 68.20 in early October but has seen a significant uptick, climbing to around CAD 75.50 by mid-month. This increase can be attributed to several factors, including robust earnings reports and ongoing demand for data center services, electric vehicles, and consumer electronics, all of which rely heavily on advanced memory technology.

In its latest earnings report released in September, Micron reported revenues exceeding CAD 9.0 billion, outperforming analysts’ forecasts. The results were bolstered by a strong demand for DRAM and NAND flash memory products, which are critical components in modern computing and mobile devices. Furthermore, Micron projected a positive outlook for the upcoming quarter, forecasting growth that could further propel MU stock.

Market Trends Influencing MU Stock

The broader market trends have considerably impacted MU stock. The ongoing global semiconductor shortage, intensified by supply chain disruptions and geopolitical tensions, continues to favor companies like Micron. Furthermore, as the digital transformation accelerates across various sectors, the increase in data generation has led to higher demand for memory solutions.

Analysts predict that as companies pivot towards more efficient cloud computing and AI technologies, the need for advanced memory modules will only intensify. Additionally, semiconductor manufacturing is increasingly being viewed as a strategic industry, drawing attention from governments for incentives and support.

Conclusion and Future Forecast

In conclusion, MU stock presents an intriguing opportunity for investors interested in the technology sector, particularly in semiconductors. While recent performance signals optimistic growth potential, it is essential to remain cautious, considering the inherent risks of stock market fluctuations. As demand for Micron’s products continues to grow amid a recovering global economy, many analysts suggest a bullish outlook for MU stock over the next year.

Investors should stay informed about the evolving global market dynamics and technological advancements that may impact Micron Technology. Keeping a close eye on the company’s earnings reports and industry trends will be vital for making informed investment decisions regarding MU stock.