Introduction

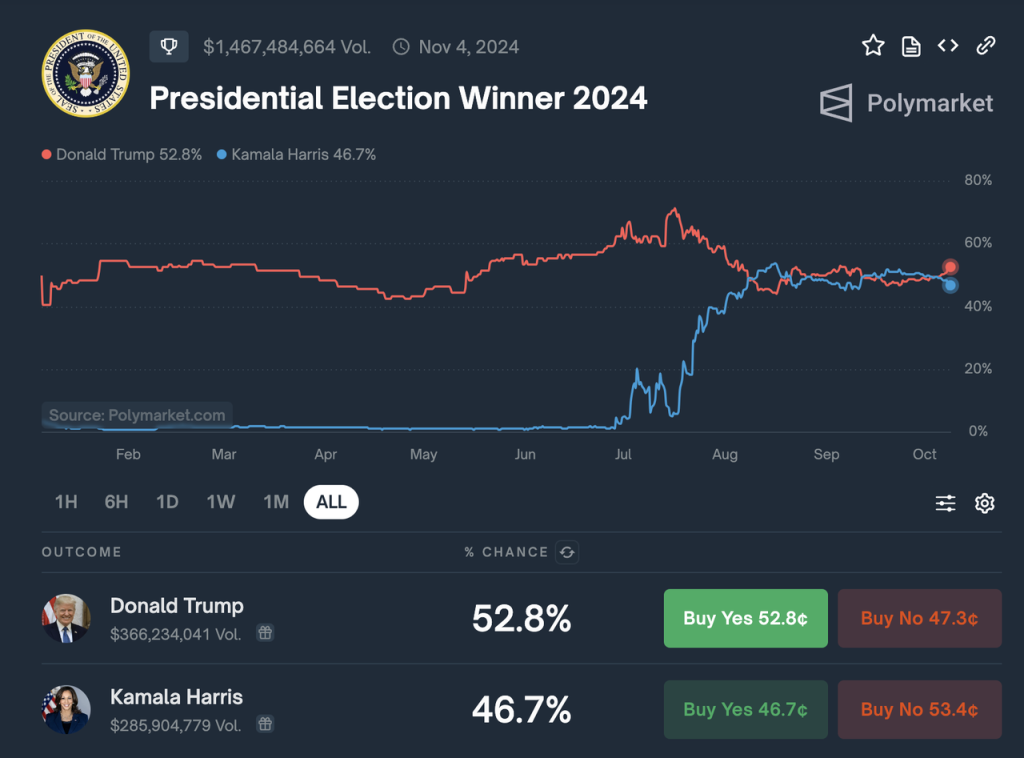

Polymarket has emerged as a significant player in the realm of decentralized finance (DeFi), particularly in the sphere of prediction markets. As a decentralized platform, Polymarket allows users to place bets on the outcomes of various events, such as political elections, sports outcomes, and other global happenings. With the rise of blockchain technology, Polymarket presents an innovative approach to forecasting and risk assessment, attracting attention from economists, investors, and casual users alike.

The Mechanics of Polymarket

Launched in 2020, Polymarket offers a unique infrastructure where users can trade shares in potential outcomes. Every market created on Polymarket allows participants to buy shares that correspond to specific outcomes of events. For instance, if a user believes a particular political candidate will win an election, they can purchase shares of that outcome. As the event approaches and the probability of that outcome changes, so too does the price of the shares, which continuously reflects community sentiment and speculation.

The platform utilizes a simple interface and a peer-to-peer approach, eliminating traditional intermediaries found in betting environments. Users transact using the Ethereum blockchain, which ensures transparency and security. This blockchain-backed prediction market has quickly gained traction for its ability to provide real-time insights into public opinion and sentiment on various topics.

Current Events and Trends

As of late 2023, Polymarket has seen significant growth in participation, especially with upcoming political events in Canada and the United States. For instance, users are actively trading on predictions related to the outcome of key gubernatorial races and legislative developments concerning key issues such as climate change initiatives and public health policies.

Moreover, regulatory scrutiny in different jurisdictions has spurred discussions about the future of prediction markets. Recent legal developments indicate that while some regulators are cautious, others are exploring frameworks to enable responsible prediction market activities, recognizing their potential benefits in gathering collective intelligence.

Conclusion

Polymarket represents a fascinating convergence of technology, finance, and social engagement. As it continues to grow in popularity, its significance lies not only in the market insights it provides but also in its potential to revolutionize how we think about risk, decision-making, and prediction. Investors and users alike should remain attentive to emerging trends and regulatory developments that will shape the future landscape of decentralized prediction markets. With its decentralized nature and innovative approach, Polymarket is paving the way for a new wave of economic participation and knowledge sharing.