Introduction: The Significance of MSTR Stock

MicroStrategy Inc. (MSTR) has gained significant attention in the stock market, particularly due to its unique business model revolving around Bitcoin investments. With the increasing adoption of cryptocurrencies and digital assets, MSTR stock has become a focal point for investors aiming to capitalize on this growing trend. Understanding MSTR’s performance and market movements is crucial for both seasoned and new investors looking to navigate the volatile landscape of cryptocurrency-related stocks.

Current Market Performance

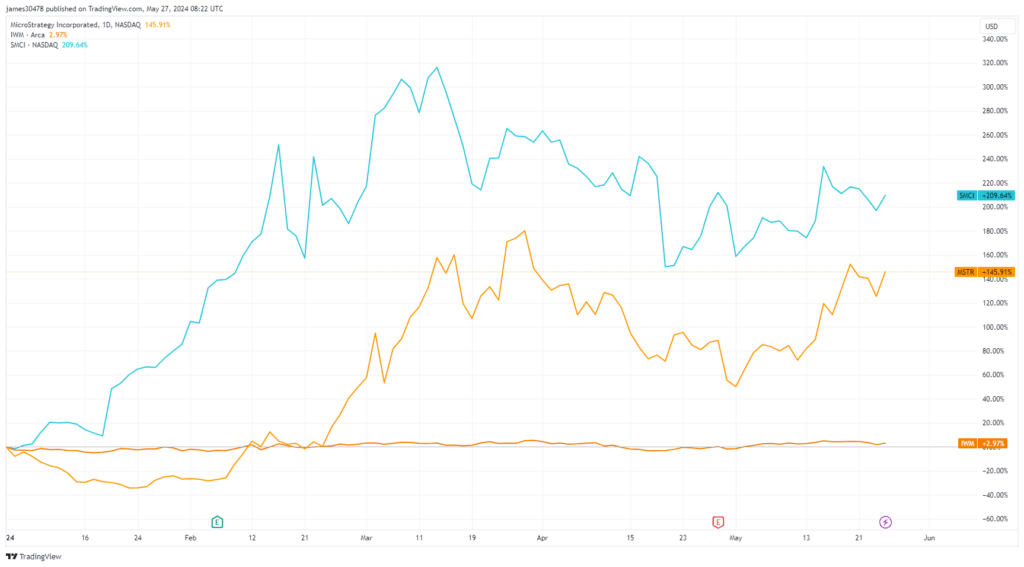

As of October 2023, MSTR stock has experienced notable fluctuations, reflecting broader market sentiments towards cryptocurrencies. The stock opened the month around $350 per share but has seen significant volatility, largely influenced by Bitcoin’s price movements. Notably, MicroStrategy has increased its Bitcoin holdings, a strategic move that has heightened investor interest. Analysts suggest that MSTR serves as a barometer for Bitcoin’s performance, with its stock price often mirroring the bullish or bearish trends of the cryptocurrency market.

Recent Developments

In recent weeks, MicroStrategy announced further acquisitions of Bitcoin, raising its total holdings to over 150,000 BTC. This decision, made amid increasing institutional interest in cryptocurrency, has bolstered MSTR stock’s reputation as a direct play on digital currency investments. Additionally, the company reported a rise in second-quarter revenues, which was positively received by the market, leading to a temporary rally in stock prices.

However, the company faces challenges in an evolving regulatory landscape for cryptocurrencies. As different jurisdictions introduce stricter regulations, there is a looming uncertainty that may affect MSTR’s operations and potentially its stock value.

Future Forecast and Investment Insights

Looking ahead, market analysts remain divided on MSTR stock. Some view it as a strong buy given its aggressive expansion into Bitcoin, expecting the cryptocurrency to rebound in the near future. Others caution that the price volatility associated with Bitcoin poses significant risks, suggesting that MSTR may not be suitable for conservative investors.

Key factors that could influence MSTR stock include advancements in blockchain technology, regulatory developments, and changes in the global economic landscape. Investors are advised to stay abreast of these trends and consider their risk tolerance before investing in MSTR.

Conclusion

MSTR stock presents a unique opportunity intertwined with the cryptocurrency market, appealing to investors looking to diversify their portfolios with digital assets. While the potential for high returns is evident, it is essential for investors to approach MSTR with caution due to the inherent risks. As the market continues to evolve, so too will the implications for MSTR, making it a stock worth monitoring closely.