Introduction

As the telehealth industry continues to grow, Hims & Hers Health, Inc. (commonly known as Hims) has gained significant attention from investors. This company operates in the healthcare sector, providing online consultations and a variety of wellness products, primarily focusing on men’s and women’s health. Understanding the performance of Hims stock is crucial for investors seeking to capitalize on the evolving healthcare landscape and the rising demand for telemedicine solutions.

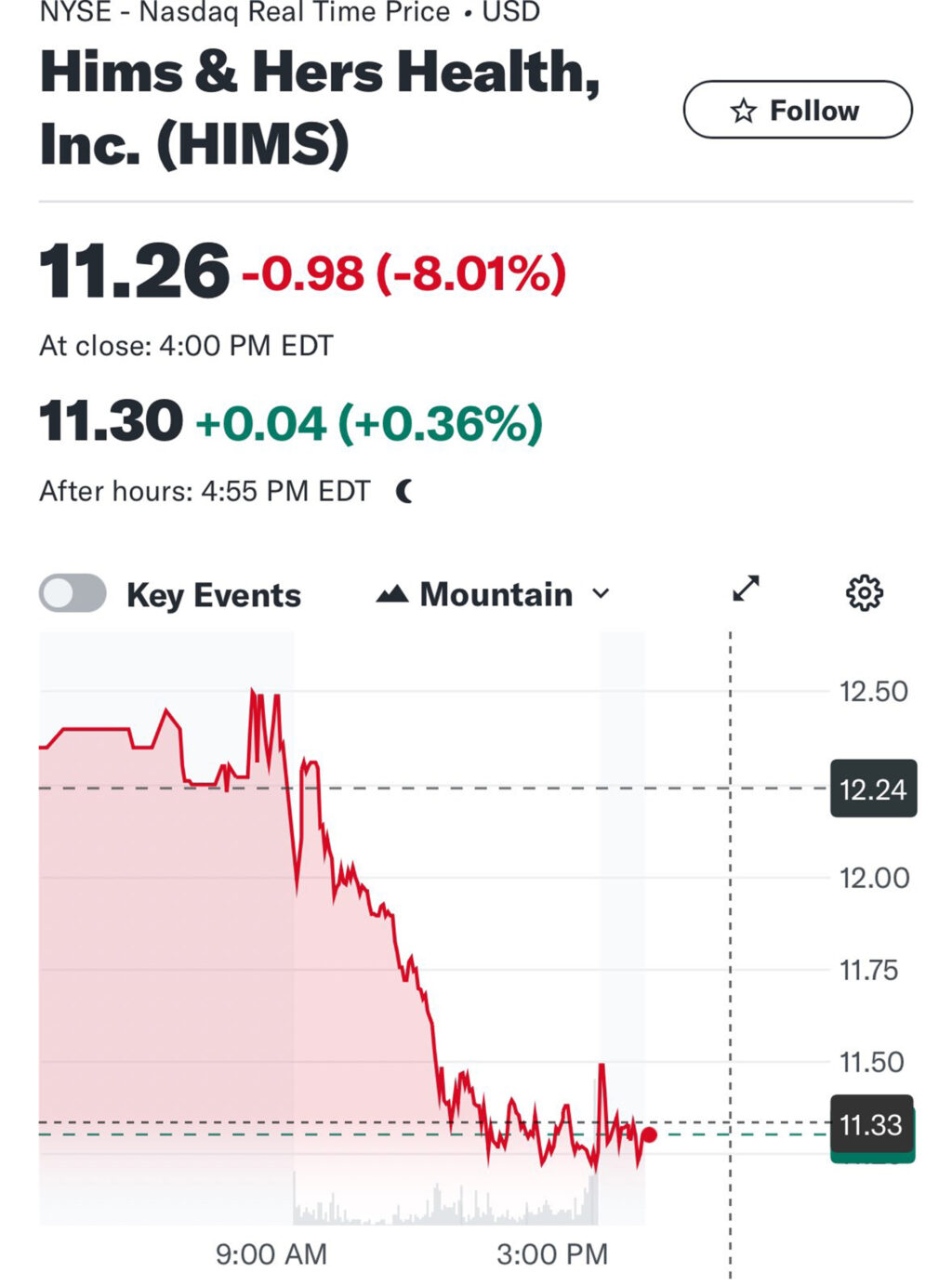

Recent Performance of Hims Stock

In recent months, Hims stock has shown fluctuating performance on the market. After its IPO in early 2021, the stock experienced a rapid rise due to increased interest in telemedicine, a trend accelerated by the pandemic. However, as market conditions shifted and economic factors came into play, Hims stock faced downward pressure, leading to a significant decline from its peak value. As of late October 2023, the stock has been trading at approximately $7.50 per share, marking a challenging period for the company amid broader market volatility.

Market Influences and Company Developments

Several factors have contributed to the current state of Hims stock. Firstly, the market’s overall sentiment towards growth stocks, particularly in the tech and health sectors, has influenced investor decisions. In addition, Hims has been actively expanding its product offerings, including mental health services, which has drawn attention to its growth potential. Recently, the company announced plans to increase its advertising budget to boost brand awareness and drive revenue. Analysts are closely monitoring this decision to determine if it will lead to positive stock performance in the upcoming quarters.

Conclusion and Future Outlook

In conclusion, Hims stock presents both challenges and opportunities for investors. While the company is facing headwinds due to market shifts, its strategic initiatives in expanding services and fostering brand recognition could pave the way for future growth. Analysts suggest that if Hims can effectively leverage its position in the growing telehealth sector, the stock may rebound as the market stabilizes. For potential investors, staying informed about the developments within Hims and the broader healthcare industry will be essential in making informed investment decisions.