Introduction

The price of Bitcoin (BTC) against the US dollar (USD) is a topic of significant interest and volatility in the financial world. As the leading cryptocurrency, Bitcoin’s price movements are pivotal not only for investors but also for traders, economists, and those interested in the future of digital currencies. In recent months, BTC has seen noteworthy fluctuations, impacted by economic indicators, regulatory environment, and market sentiment.

Current Market Overview

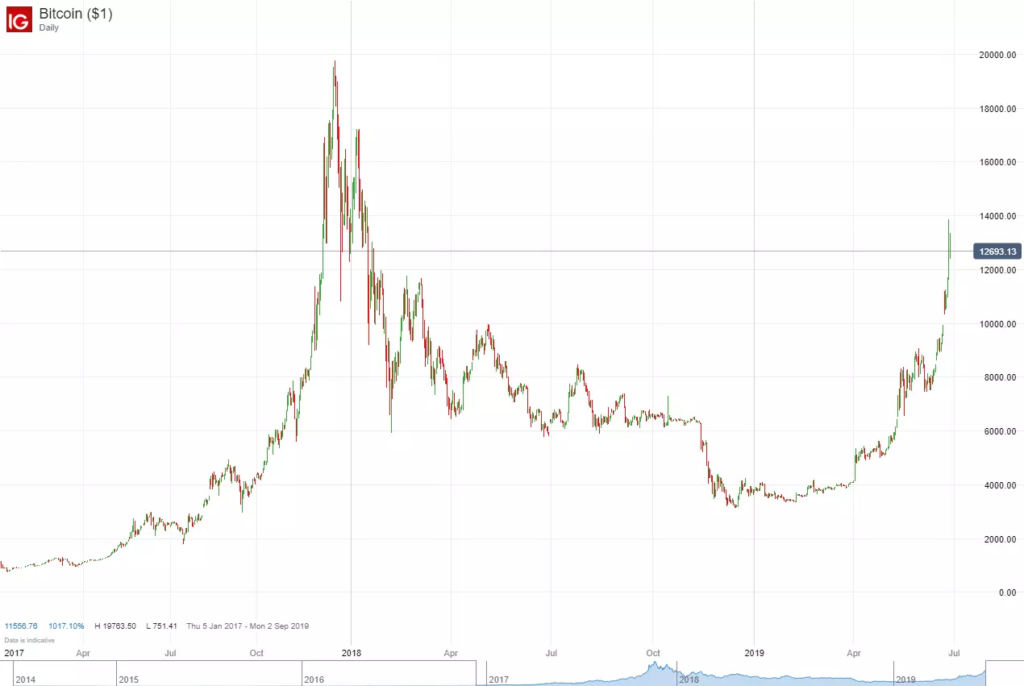

As of October 2023, Bitcoin is trading at approximately $40,000 USD. After reaching an all-time high of nearly $65,000 in November 2021, BTC experienced a substantial bear market throughout 2022, dropping to lows around $16,000. The current price reflects a recovery phase, driven by renewed interest from institutional investors and increasing adoption by various sectors, including finance and technology.

Factors Influencing BTC Price

Several factors are influencing the fluctuating BTC price against the USD:

- Market Sentiment: Investor confidence significantly impacts Bitcoin’s price, with factors such as positive regulatory news and institutional investments leading to bullish trends.

- Regulatory Developments: Increasing scrutiny from governments regarding cryptocurrency regulations can cause price volatility. Recent measures by the SEC and other regulatory bodies are especially influential.

- Global Economic Climate: The macroeconomic environment, including inflation rates and interest rate hikes by the Federal Reserve, plays a crucial role in determining BTC’s price as investors seek alternatives to traditional assets.

Recent Events

In recent weeks, Bitcoin’s price surged due to positive sentiment following major financial firms announcing crypto-related products. Notably, the launch of Bitcoin ETFs (Exchange-Traded Funds) in North America has sparked renewed interest, making it easier for traditional investors to gain exposure to Bitcoin.

Looking Ahead

Forecasts for BTC price remain varied. Analysts are divided, with some predicting a return to all-time highs as adoption increases, while others caution that regulatory pressures could stifle growth. Market predictions suggest Bitcoin could range between $30,000 to $60,000 USD over the next year depending on these influencing factors.

Conclusion

The BTC price against the USD continues to be a focal point for a myriad of stakeholders in the cryptocurrency space. Understanding the factors that influence this price is crucial for anyone looking to navigate the digital asset market. As Bitcoin seeks to establish itself further in the global financial system, close attention to economic changes and regulatory developments will be paramount for investors and enthusiasts alike.