Introduction to TQQQ

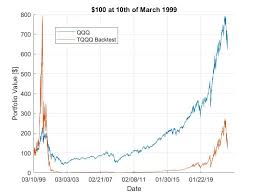

The ProShares UltraPro QQQ (TQQQ) is a leveraged exchange-traded fund (ETF) that seeks to deliver three times the daily performance of the Nasdaq-100 Index. Understanding TQQQ is essential for investors looking to maximize their exposure to one of the most significant stock indices, especially as the tech sector experiences substantial fluctuations. Given its potential for high returns and increased risks, TQQQ represents a fascinating opportunity in the world of investing.

How TQQQ Works

TQQQ operates by using financial instruments such as swaps, futures contracts, and options to achieve its investment objective. The ETF seeks to provide investors with triple the daily percentage change of the Nasdaq-100, meaning if the index gains 1% in a day, TQQQ aims to gain approximately 3%. However, this also means that losses are amplified. If the index drops by 1%, TQQQ would likely fall by about 3%. This leverage can create significant volatility in the short term, making TQQQ more suitable for tactical traders rather than long-term investors.

Market Performance and Recent Trends

As of late 2023, TQQQ has faced considerable market dynamics influenced by broader economic indicators, including inflation rates and Federal Reserve policy changes. In the past months, the tech industry has rebounded after a period of turbulence, pushing the Nasdaq-100 higher. Consequently, TQQQ has also shown strong performance, with year-to-date gains exceeding its typical movements, reflecting investor optimism in tech stocks.

Moreover, the introduction of AI technologies and robust quarterly earnings reports from major tech players have buoyed sentiment in the sector. However, investors must approach with caution, as the same factors contributing to gains can quickly reverse. The economic landscape remains uncertain, and TQQQ’s leveraged nature means it can react sharply to market conditions.

The Importance of Risk Management

For investors considering TQQQ, understanding risk management strategies is crucial. The use of stop-loss orders and careful monitoring of market conditions can mitigate potential losses. Additionally, many investors opt to include TQQQ as a small component of a well-diversified portfolio, limiting their overall exposure to risk while capitalizing on potential market upside.

Conclusion: Navigating Opportunities with TQQQ

TQQQ embodies both opportunity and risk in today’s financial framework. It offers investors a chance to multiply their exposure to the tech-heavy Nasdaq-100, aligned with emerging trends in technology. As economic conditions and market sentiments fluctuate, it’s important for investors to stay informed and continuously evaluate their investment approach regarding leveraged ETFs like TQQQ. With careful strategy and risk awareness, TQQQ can be a valuable asset for investors looking to navigate the complexities of the modern stock market.