Introduction

AMD stock, representing the shares of Advanced Micro Devices, Inc., has gained significant attention among investors and analysts in recent years. The semiconductor industry has seen considerable growth, driven by increasing demand for computing power in various sectors, including gaming, cloud computing, and artificial intelligence. As AMD continues to innovate and expand its market presence, understanding its stock performance is essential for potential investors looking for opportunities in this promising market.

Recent Developments in AMD

As of October 2023, AMD stock has experienced notable fluctuations due to various factors impacting the semiconductor landscape. In the third quarter of 2023, AMD’s revenue growth reached an impressive 15% year-over-year, primarily attributed to the strong performance of its EPYC server processors and Ryzen gaming CPUs. This growth comes amid a broader recovery in chip demand as supply chain issues subside.

Analysts have also pointed to AMD’s strategic partnerships and acquisitions, including its recent agreement with a leading cloud provider to enhance its data center offerings. This collaboration is expected to bolster AMD’s competitive position against rivals like Intel and NVIDIA, further fueling investor interest.

Market Analysis and Stock Performance

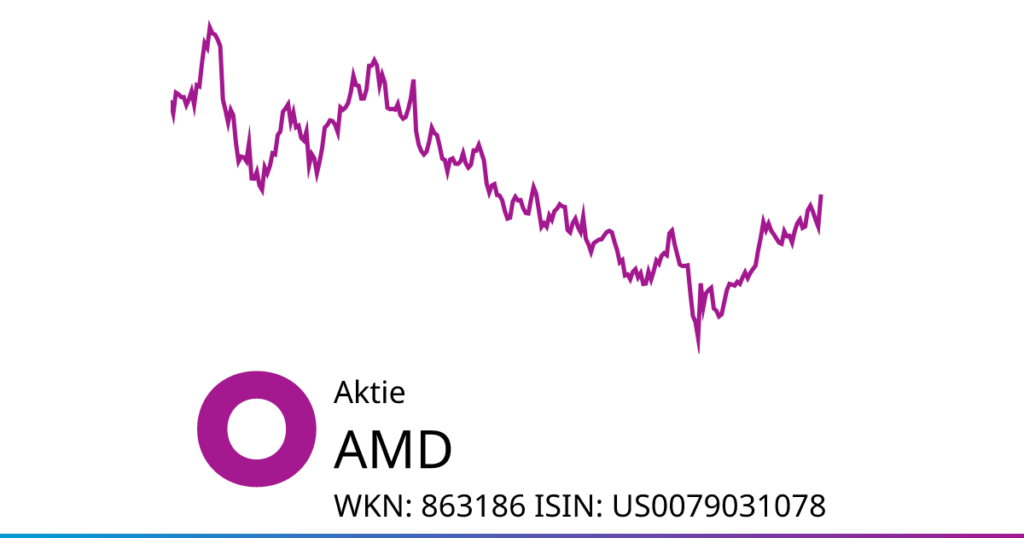

As of this month, AMD stock is trading at approximately $110, showing a recovery from its low of $80 earlier in the year. Market analysts suggest that the stock may continue to rise as the demand for high-performance computing solutions increases. Notably, AMD recently announced an expansion of its semiconductor fabrication capabilities, which is anticipated to meet the growing demand across various industries.

In addition, financial analysts have raised their price targets for AMD stock, with some projecting it could reach as high as $130 in the next 12 months, depending on market conditions and the company’s performance in upcoming earnings reports. Investors are advised to keep an eye on these developments as they weigh the potential risk versus reward in adding AMD stock to their portfolios.

Conclusion

As AMD continues to innovate and adapt to the ever-evolving semiconductor market, its stock remains a focal point for many investors. With strong revenue performance, strategic partnerships, and a positive market sentiment driving interest, AMD stock appears to have potential for continued growth. However, it is crucial for investors to conduct thorough research and stay informed on market trends and company performance to make sound investment decisions. As the semiconductor industry continues to expand, AMD’s role within it will likely shape the future of technology investment portfolios.