Introduction

The stock market has shown signs of a significant bounce back recently, a trend that has garnered the attention of both investors and economic analysts alike. After a turbulent period marked by inflation fears, interest rate hikes, and geopolitical tensions, the resurgence of market confidence is vital for the overall health of the economy. Understanding the factors contributing to this rebound is essential for investors seeking to navigate the complexities of today’s financial landscape.

Current Events Surrounding the Bounce Back

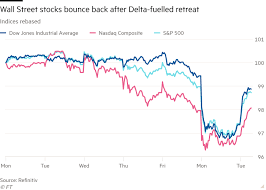

As of October 2023, major stock indices, including the S&P 500 and the TSX, have experienced notable recoveries. The S&P 500 surged over 5% in the last month alone, fueled by strong corporate earnings reports and resilient consumer spending. This uptick follows a longer phase of market volatility, where rising interest rates led to widespread sell-offs.

The earnings season has played a crucial role in revitalizing confidence. Companies in various sectors, including technology and consumer goods, have reported better-than-expected profits, dispelling fears of recession. For instance, tech giants like Apple and Microsoft announced record revenues, driven by robust demand for their services and products.

Factors Behind the Recovery

Several factors are contributing to the stock market’s bounce back. Firstly, the Federal Reserve’s decision to pause further interest rate hikes has alleviated some pressure on borrowers and consumers. In addition, inflation rates have shown signs of stabilizing, which helps the purchasing power of consumers and the overall economic sentiment.

Furthermore, institutional investors appear more optimistic, as evidenced by increased capital flows into equity markets. Analysts report a shift toward riskier assets, highlighting a renewed appetite for growth amid positive economic indicators. Notably, retail investors are also increasingly confident, as the average investor has actively participated in the market rebound.

Conclusion

The stock market bounce back signifies a crucial turning point amid previous uncertainties. While it is essential not to overlook the potential for future fluctuations, the current trajectory offers a hopeful outlook for investors. As economic indicators continue to improve, experts suggest that careful investing can yield significant returns. Analysts encourage both new and seasoned investors to stay informed and remain adaptable in this dynamic market environment, ensuring they are prepared for any eventualities.