Introduction to Suncor Stock

Suncor Energy Inc., one of Canada’s leading integrated energy companies, has been a significant player in the oil and gas sector. With fluctuations in global oil prices and an increasing focus on sustainable energy, Suncor stock has garnered attention from both investors and analysts. Understanding its stock performance is essential for anyone interested in the energy market, especially as Canada emphasizes a balance between energy production and environmental responsibilities.

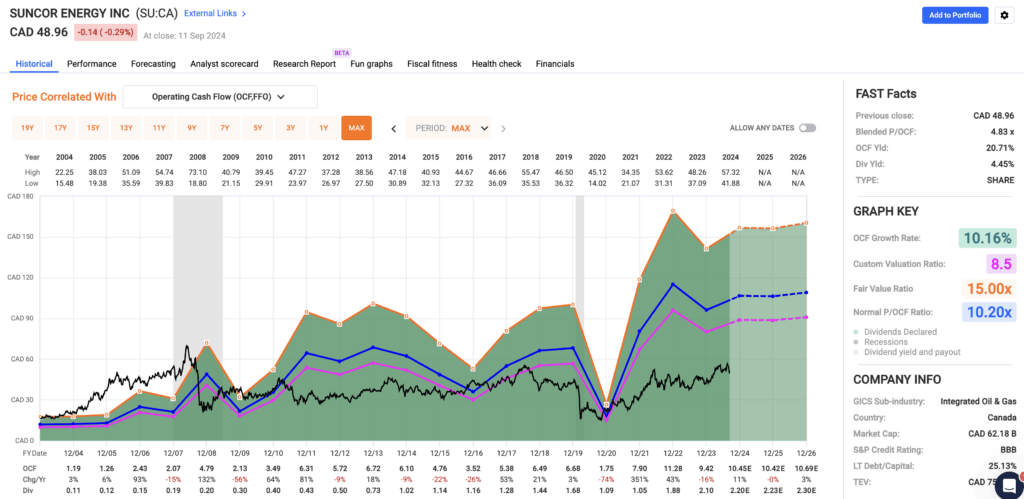

Recent Performance

As of October 2023, Suncor’s stock saw a notable increase of approximately 15% over the past month. Factors contributing to this surge include a rise in crude oil prices, which recently reached their highest levels in several years due to geopolitical tensions and recovering demand post-pandemic. Additionally, Suncor’s strategic initiatives to enhance its production capabilities and reduce carbon emissions have positioned the company favorably in a market that is increasingly favoring sustainable practices.

Market Reactions

Analysts have responded positively to Suncor’s latest earnings report, which showcased strong revenue growth and improved profit margins. The company reported revenues of CAD 12 billion for Q3 2023, a substantial increase from the previous year. Analysts predict that Suncor’s stock may continue to rise if crude prices sustain their current levels and if the company effectively manages its operational costs amidst potential regulatory changes in Canada’s energy sector.

Investors’ Outlook

While many investors remain optimistic about Suncor’s growth trajectory, there are concerns regarding the future of fossil fuel investments amid growing climate policies. This has led to divided opinions in the investment community. Some investors are looking at Suncor as a short-term opportunity, capitalizing on rising oil prices, while others are wary of long-term sustainability given the global shift towards cleaner energy sources.

Conclusion

In summary, Suncor stock presents a compelling case for both short-term and long-term investors navigating the complexities of the energy market. With the company poised to benefit from current market trends, potential buyers should weigh the benefits against the risks associated with environmental impacts and shifting market sentiments. As Canada continues to evolve its energy strategies, Suncor’s adaptability will be crucial in securing investor confidence and maintaining its position as a leader in the energy sector.