Introduction

Visa Inc. has long been an influential player in the global payments industry, making its stock a topic of interest among investors and financial analysts alike. With recent economic shifts and changes in consumer behavior, monitoring Visa’s stock performance has become increasingly relevant. Understanding Visa stock is vital for investors seeking to navigate the complexities of the financial markets and make informed investment decisions.

Recent Performance of Visa Stock

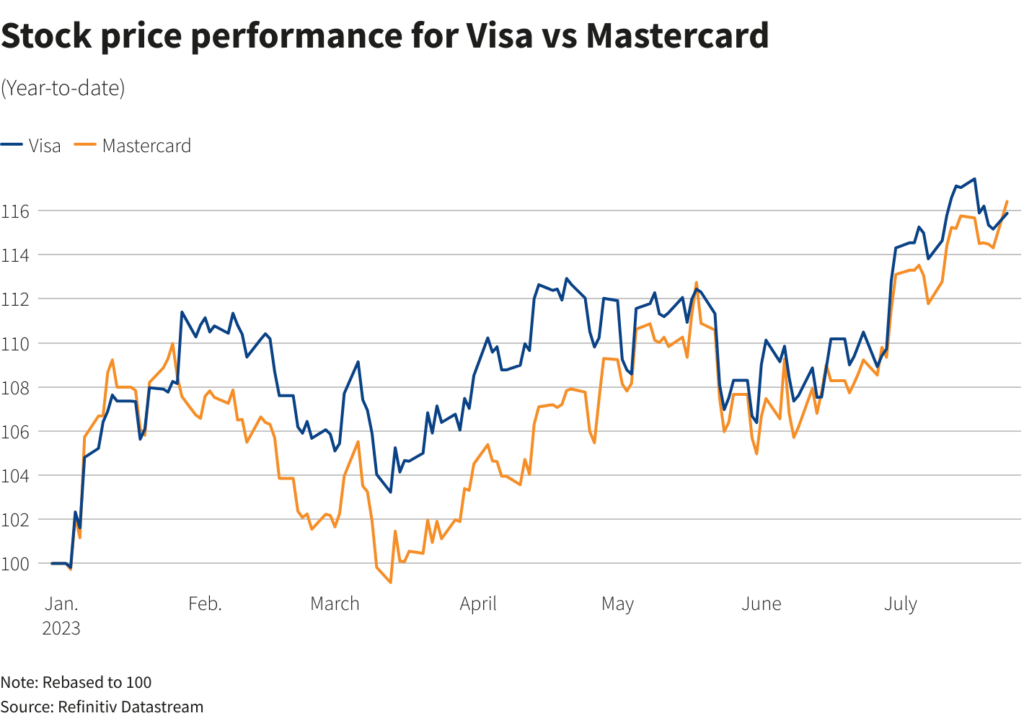

As of mid-October 2023, Visa’s stock has demonstrated a robust performance amidst fluctuating market conditions. Year-to-date, Visa shares have risen approximately 15%, outperforming the broader market indexes such as the S&P 500, which has experienced lower growth rates in the same period. This growth can be attributed to several factors, including the rebound in consumer spending post-pandemic, increasing adoption of digital payments, and strategic partnerships that enhance Visa’s market presence.

Key Factors Influencing Visa Stock

1. Digital Payment Trends: The ongoing shift towards digital and contactless transactions has bolstered Visa’s business model, leading to higher transaction volumes and revenue growth. Recent data shows that online transactions have surged, contributing significantly to Visa’s income.

2. Global Expansion: Visa continues to expand its footprint in international markets. Recently, the company entered new partnerships in emerging markets, facilitating cross-border transactions and mobile payment solutions, which are expected to drive growth.

3. Tech Innovations: Investments in technology and cybersecurity are critical for Visa to maintain its competitive edge. The company’s initiatives in blockchain technology and mobile payment security have positioned it as a reliable payment processor, attracting more businesses.

Challenges Ahead

Despite its strong performance, Visa must navigate potential challenges that could affect its stock. Regulatory scrutiny regarding data privacy and competition from fintech companies could pose risks. Additionally, economic uncertainty, including inflation and potential downturns, may impact consumer spending and transaction volumes.

Conclusion

In summary, Visa’s stock remains a vital component in the financial sector, reflecting broader economic trends and consumer behaviors. For investors, staying informed about Visa’s market performance and the factors influencing it can provide valuable insights. As the payment landscape continues to evolve, Visa’s ability to adapt and innovate will be crucial in maintaining its market leadership and ensuring a positive outlook for its stock. Analysts forecast steady growth for Visa, making it a stock worth watching in the upcoming quarters.