Introduction

BA stock, representing The Boeing Company, has been a focal point in the aviation and aerospace sectors. As the world continues to recover from the pandemic, understanding the trends and movements in BA stock is crucial for investors and stakeholders alike. Boeing’s performance is a barometer for the wider commercial aerospace market, making it an important consideration in investment portfolios.

Current Performance Overview

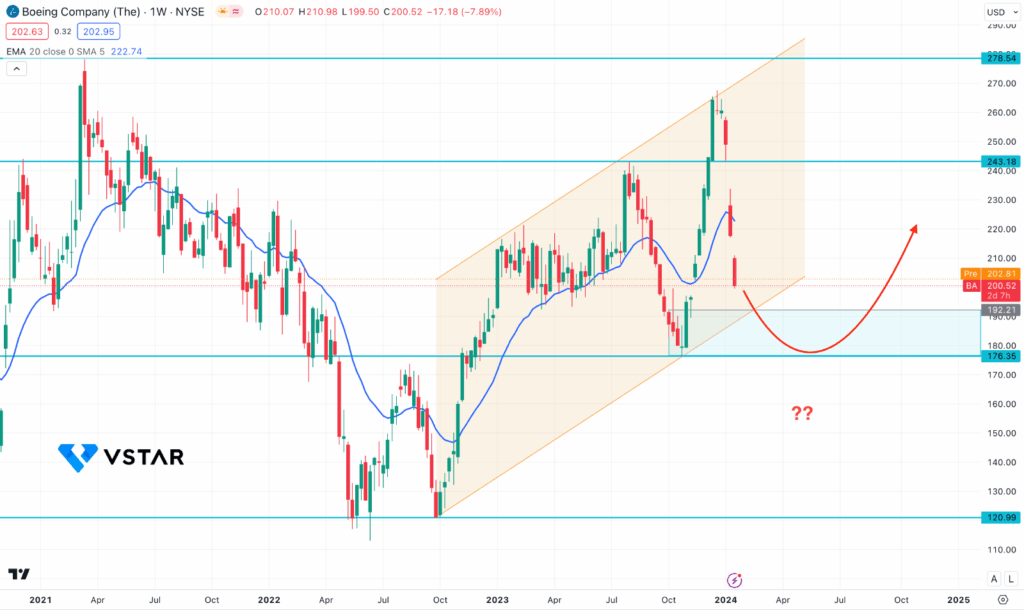

As of mid-October 2023, BA stock has seen notable fluctuations attributed to various factors such as supply chain disruptions, changes in demand for air travel, and geopolitical tensions. Recent reports indicate that Boeing has ramped up production of its 737 MAX aircraft, a positive signal for investors looking at long-term growth. The stock is currently trading at approximately $220, reflecting a modest recovery from the lows experienced in previous years, though it remains under pressure from industry-wide challenges.

Factors Influencing BA Stock

Several key factors are influencing Boeing’s stock performance currently:

- Supply Chain Challenges: The ongoing global semiconductor shortage has affected production timelines, and Boeing is working closely with suppliers to mitigate these issues.

- Travel Demand: With airlines reporting a surge in passenger traffic as travel restrictions ease, demand for new aircraft is expected to rise. Analysts are predicting a solid recovery in the aviation sector, which could positively influence BA stock.

- Regulatory Environment: Government regulations and safety inspections are critical for Boeing, especially in light of previous issues involving the 737 MAX. The company is actively working to regain trust and compliance with regulatory agencies.

Outlook and Conclusion

Looking ahead, analysts remain cautiously optimistic about BA stock’s trajectory. The company’s efforts to address supply chain challenges and the projected growth in air travel are expected to play a significant role in its performance. However, investors should remain aware of the potential risks, including any changes in regulatory scrutiny or market competition. Overall, understanding the evolving landscape surrounding BA stock can aid investors in making informed decisions, especially as the aerospace industry continues to adapt in a post-pandemic world.